In present times, Fintech, or financial technology, is one of the largest growing sectors. It is a combination of technology and time-saving financial services. In this era of technology, Fintech app development is evolving due to the increase in demand for online banking, mobile payments many more services to make the process of money transfer seamless, convenient or quick.

The fintech market is evolving rapidly, it is predicted that the value of the worldwide fintech market was USD 194.1 billion in past years which is now expected to increase at a CAGR of 16.8% to reach USD 492.81 billion between 2023 – 2028. Excessive investment done by multiple governments to sustain the growth of the digital economy causes an increase in the market growth of fintech apps. Increased use of Online banking or online payments has affected the growth of the fintech business. Many companies are looking for ways to develop a fintech app to meet the market demand and achieve success.

What is a Fintech Application?

A fintech application is a software application developed for providing financial services by utilizing modern technologies. It offers multiple services like online banking, investing, insurance, budgeting, payment along with money transfer.

These applications have become a necessity for people and businesses as it makes it easy to manage money transfers, track their investments, and get loans in a more secure manner than ever before. It is essential to improve financial services and meet market demands. That’s why fintech app development companies are specializing in designing and modification of their applications.

Features to take into account while creating a fintech app

Financial organizations can attract new customers and retain old ones by creating a mobile app for their financial services. If you want to create a fintech app look around for a well-known development company.

Intuitive Interface and easy navigation:

Initially, the app’s user interface must be simple and easy to use. Many applications give users a disconnected experience and inadequate basic instructions, which causes visitors to lose interest in it and switch to other apps. A voice search or written request feature and intelligent shortcuts to frequently used app features are required to simplify the app’s navigation.

Top App Ideas For Startups To Launch

Security features:

A fintech application needs to require robust security measures to safeguard personal information and financial data by using encryption, blockchain technology, etc security measures for safe financing. You need to ensure that the finance app development company you have approached is using potential security measures in your application or not as a fintech app requires high security to gain consumer trust.

Notifications:

Staying in touch with customers and advertising particular offerings depending on their demands requires notifications and reminders. If messages are too often or invasive, customers may find them annoying. Visitors must have the option to choose or set the frequency, timing, and type of information they receive. Customers will profit from this feature because they won’t miss important alerts.

Personalized experienced:

This is the basic need of every user no matter the app. This feature should be there in every app as users demand personalized experiences. The fintech app should be convenient, easy, and customizable according to the user’s needs. You can do this by adding features like my profile for adding their personal information and interest. You can use this information to offer personalized recommendations.

Digital payments:

Digital payments feature is the heart of Fintech apps as it enables payments easily and fast via online. Fintech companies facilitate users to shop online by providing digital payment options in the app. Better payment features result in increased profit and sales for a supplier as it will increase the ability of users to pay online. To stand out in the competitive market a mobile app development company should focus on creating enhanced features for digital payment in their fintech app.

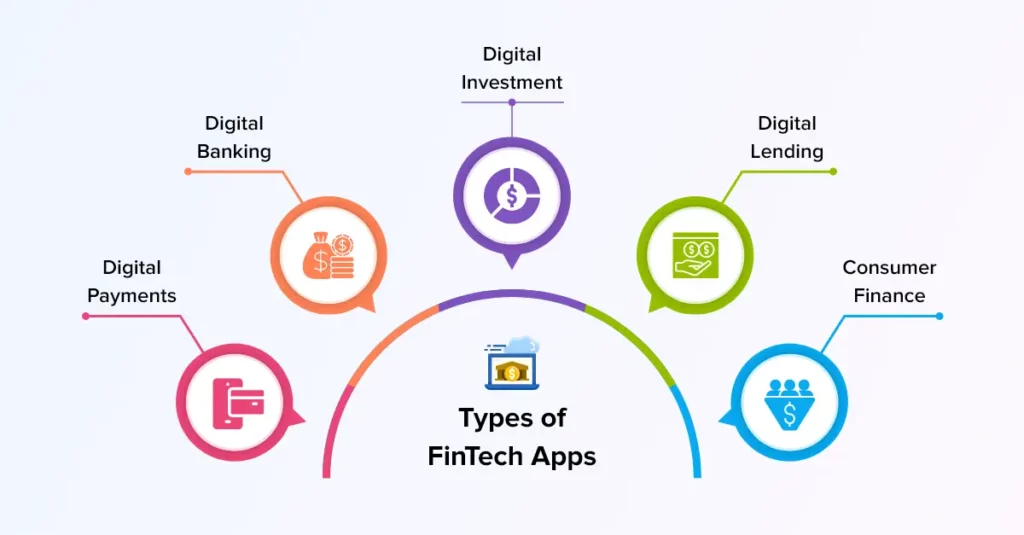

Types of Fintech Applications

Digital Payment and Money Transfer Apps:

Being cashless is a trend nowadays. For fast and secure cashless payments Digital payment apps are created. These types of fintech apps are for the insurance sector. It makes the process of claiming easier, streamlines the management of policies and prevents criminal activity. The primary feature of an insurance app is its ability to process payments, file claims, get rates, search for policies based on various criteria, and more.

Mobile Banking Apps:

Customers can receive financial services and manage their accounts with the help of digital banking apps without visiting a branch physically. In order to offer financial services whenever and wherever needed, it includes both mobile and online banking.

Personal Finance Management apps:

These applications help users properly manage their own finances by providing information on their finances on a single dashboard. It enables people to have better control over their finances, they offer budgeting tools to manage their expenses, cost monitoring, bill reminders, and financial goal-setting capabilities.

Digital Lending:

It is difficult for lenders to get a complete analysis of their applicants due to the heavy burden of work and time-consuming tasks. It helps in collecting information on the applicants, account balance, number of assets, and more. It also simplifies another challenging task of getting borrowers to link their bank accounts so that they can obtain loans or ask to repay.

Investment apps:

Investment apps enable investors to finance in stock markets, bonds, mutual funds, or other financial tools. The app consists of features like tracking portfolios, current market data, and recommendations for investment on the basis of the information gathered by the app can also perform trades.

Process of building a fintech applications

Choose an application Niche & define its concept:

It’s essential to understand the app concept in-depth and determine the target market before creating a fintech app. This will enable you to stand out your product from rivals on the market and help you create a fintech app that is more focused and appropriate.

Deal with Compliance:

It is important to comply with legal issues before you start to develop a fintech app. It is for safeguarding consumers from fraud, encouraging fair competition, and assuring complete privacy and security in the fintech industry. You must study the laws and regulations regarding the fintech app to avoid legal issues. Some legal formalities include licenses, registration of the app, terms & conditions for privacy, and some regulations specifically for fintech apps like Anti-Money Laundering, Know Your Customer (KYC), etc.

Shape the concept with market research:

You need to make your concept clear about who is your target audience for whom you are building this app. It’s essential to conduct market research to identify whether there are similar apps already available in the market or not. If yes, then why is your app unique? make sure you have new features to attract your audience, research the problems customers are facing in the already available app try to resolve them to serve better.

Create or Hire Your Development Team:

After understanding the concept of your app and completing research on the market & audience next is to build a development team that is experienced as well as experts in their fields to develop a fintech app with unique features and impressive functionality to make your app lively. It is better to go for a reputed Company to get reliable mobile app development services as a team of freelancers sometimes takes your project for granted due to working on many projects together. Hiring from a company provides security assurance, timelines, and project tracking under your budget.

Focus on UIUX design:

After building a team for development the next crucial component of developing a financial app is having an appealing & engaging UI/UX design that enables users to interact with the software. The mobile application development team needs to make sure that the app is user-friendly. You can have your team create some prototypes to identify which design will go better.

Features and functionality App:

Make a list of key features and functionality for your fintech app development according to your market research and customer feedback. List these components in order of importance, user requirements, and challenges in fintech development. You should also focus on the MVP model for features and functionality.

Create a monetization strategy:

The next step to make your app successful for a long period is a clear and perfect monetization strategy. If you choose the right fintech app development company, it will make you achieve your goal and help you earn profit.

Choose your technology stack:

After completing research, legal formalities, design, and development now move towards choosing the right tech stack for your app. Your choice of tech stack will affect your performance and scalability. Hence, make sure you choose a robust technology stack keeping in mind the needs and expertise of your developers. Some of the popular technologies recently used by companies to develop a fintech app in both the frontend like React, Angular or in the backend like Node.js, Ruby on Rails, etc.

Build an MVP model:

It’s time to create a minimum viable product (MVP) after your technology stack is in place. The basic features of your software that are required to address the issue that you found should be included in the MVP. Before spending additional time and money on developing the entire app, you can quickly test the market and obtain feedback from customers and the community in this manner.

Tips To Create An App Like Splitwise

Implement security measures:

When it comes to money people become more anxious about security. So while making a fintech app security measures should be at the top of your priority list. It should have data encryption policies, login features, blockchain-based security, and tracking security exposures regularly because fintech apps often suffer from cyber attacks.

Refine by testing and launching your App:

The final step of your app is to refine your app from bugs and errors with the help of quality assurance testing. Once your app passes the testing process it is purified and ready to launch. You will need permission from stores like PlayStore or AppStore to upload your app on them to reach an extended audience worldwide.

How much does it cost to develop a Fintech app?

The cost of creating an app depends upon the features and functionality of your application the more advanced features and technologies you integrate the more will be the cost. You can search for cost-effective mobile app development services in India as developing countries cost less as compared to developed countries and provide better services as well. The estimated cost to create a fintech app is between $20,000 – $100,000 and more according to your project requirements.

Final Takeaways from Fintech Application Development

We are aware of the fact that creating a fintech app is going to be beneficial as it has excellent scope in the future. The above statistics and research prove that the demand for financial technology apps is increasing. With the increase in demand and adoption, competition is also growing at a high rate.

To meet the demand and compete in the market you need to create a feature-rich and out-of-the-box fintech application that stands out in the crowd of apps. It is only possible by approaching a finance app development company that acquires the required expertise and skills to create a fintech app for your business at affordable rates.

Frequently Asked Question

What factors affect the cost of Fintech applications?

Many factors can affect the cost such as complicated advanced features, integration of modern technologies, development platforms, & developers’ salaries as experienced developers cost more as compared to freshers as well as their location like developers from well-established countries are more costly than developing countries.

What is the reason for the success of fintech apps?

The financial sector is modernized with fintech apps as it can target the needs and demands of users more accurately optimizing traditional banking solutions by integrating cutting-edge technologies with fintech.

What is KYC?

KYC is a short form for Know Your Customer. It is a process that enables fintech businesses to stick to the laws and regulations of fintech applications and also prevent them from vulnerabilities. KYC consists of the following features: user authentication, verification, analyzing the risk score and continuous tracking.

Related Post: