Fintech stands for financial technology when any finance merges with technology for good performance and more efficient process when word fintech is used. For fintech, there is no specific definition for banking departments such as the personal finance section, mutual funds, and all other finance departments; from all these things, it evolves and sounds like fintech.

For making it easier for people, financial software development companies are trying to be accessible by using smartphones with the help of mobile banking, borrowing services, and many other things; moreover, finance company consists establishing financial institutions and startups that are also trying to replace technology companies.

Fintech companies use different types of technology such as big data, Artificial Intelligence (AI), Robotic Process Automation (RPA), and blockchain. In contrast, AI algorithms can watch client spending habits, and it allows the financial institution to know their clients. There is also one thing that has been used: a chatbot is a tool that banks are using to help with customer service.

Other fintech companies such as Clair create technology and plaid company. These companies supplement technology and improve existing financial services such as augmenting payroll services or consumers and transferring funds between a bank with companies; from all these things, you can get an idea about fintech.

Why is Fintech Important for the Future?

Nowadays, many businesses are running through fintech compared to past years. There are four main reasons to invest in fintech apps.

- Easier payment process

- Evaluating risks

- Faster investment

- Lower cost

Easier payment process

In this modern era, the main reason to develop fintech is to make the payment process more manageable. The Fintech app has saved your time by using credit cards, digital wallets, and online banking apps that can make debit card payments through Fintech transactions.

Evaluating risks

When an online payment system has come at that time, people fear getting their money at risk. Still, when a fintech app development company has come to the market, individuals have overcome the risk and make their payments more quickly. Then it comes to lending loans for any transaction in which they fear fraud and risk of error payment.

Faster investment

Fintech app development has provided financial advisors and 24/7 consultation and extensive advice via mobile app. This can enhance the process and give better suggestion options. Open new doors for entrepreneurs for investments and loans by creating banking and non-banking platforms.

Lower cost

To register in the financial business, money is taken in the market, where financial services are accessed on a device such as a smartphone. Fintech has improved the (POS) point of sales system and reduced the charge of the business; added analytics data to keep their client busy.

Here are some features which you need to know before you invest in a FinTech app:

- Build a secured platform

- Introduce innovation and Artificial Intelligence

- Changes the dynamics of customer experience

- Reimagining the future with blockchain services

- Robust notification system

- The easy and secure registration process

- Chatbot

- Push notifications

- Fingerprint login

- Voice banking app

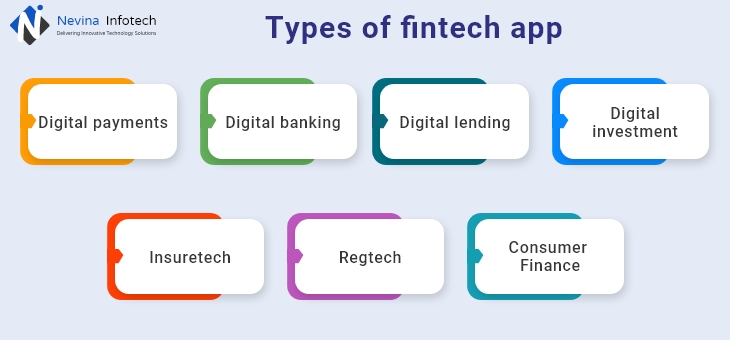

What are the Different Types of Fintech Apps?

When you start developing a mobile app for fintech, it is the most important thing to know about the different types of fintech apps that are launched in the market. So to make a successful fintech app, you should choose the right financial software development company.

- Digital payments

- Digital banking

- Digital lending

- Digital investment

- Insuretech

- Regtech

- Consumer Finance

Digital payments

Digital payment is the largest source of fintech industries; digital payment addresses the need for cashless, secure money transfer, and fast transferring. For all these things, e-wallets and digital currencies are available. There are two popular platforms available for all these things Paypal, and Payoneer.

Paypal is a digital platform for performing payments online. It enables a fast and secure transaction between vendors and customers without any financial details. Paypal also supports debit cards and credit cards. From that thing, you can register with a Paypal account.

Payoneer is also one online payment process that permits more easily known cross-border and domestic money transfers. For this financial transaction, you need to use a prepaid Mastercard among all free-lancing platforms. Payoneer is the most popular freelancer.

Digital banking

Digital banking is the best source for customers who want to open their bank accounts digitally and do financial transactions digitally without the involvement of a third party. To fulfill the needs of the customer, online mobile and digital-only banks have been involved. To compete with the growing market, traditional banks had to build financial apps. Here are the two best examples of such kinds of banks that are N26 and Revolut.

N26:- It is a digital bank that fully provides online transactions with the help of its N26 mobile app. It is safe because N26 allows linking your account with just one smartphone at a time, and before payments or any transaction, you need to allow offline and online transactions with the help of a secure PIN.

Revolut:- It is also a type of digital bank whose aim is to link globally. With the help of Revolut, one can use their already existing bank account to convert the funds deposited into various currencies. It enables free international money transfers and allows access to the cryptocurrency exchange.

Digital lending

Digital lending has dramatically changed the process of renewing and new registered loans; however, simple loan apps and websites like a comprehensive automated platform for this digital lending software give efficient handling of loan requests and impact interactions between borrowers and landowners. Here is some guideline that will help you to develop a fintech app for digital lending.

Kabbage:- Kabbage is a digital lending app that gives facilities to payment services to do business by credit most attractive about Kabbage because it doesn’t require additional fees. The business user can apply for a loan, and immediately start using their funds in some time.

Calyx Point:- Calyx Point is the best mortgage solution provider for banks, especially for brokers, mortgage landowners, and credit unions. It has been designed in a unique way for all phases of the loan process. You should also know about this digital lending tool.

Digital investment

Digital investment is a platform that allows investors and retailers to get more details to invest in different types of digital platforms. Investment apps nowadays give you a chance to invest your money in the stock market with the help of an online process. By getting the support of the finance mobile app development team, users can improve their performance by providing legit analytics and data. If you want to develop your fintech app, then here are some following things you should do to develop a better fintech app.

Hedgeable:- In Hedgeable most crucial feature is that the help of Robo-advisor gives wealth management to the investors. It also offers customized features and options for automated investing. Its annual amount fees are based on the amount of the investor account.

Addepar:- Addepar gives solutions to investors and advisors, so it is also known as investment management. This Addepar’s main aim is a global financial system for different types of currencies of the world with the help of Addepar businessmen get a clear view to communicate for financial decisions.

Insuretech

Insuretech and other digital insurance companies make a deal with technologies used in the insurance industry field these two companies have set their goal to do claim processing and increase the speed of policy administration as fast as they can. Insuretech company differs from other basic websites offering insurance sometimes for the people who borrow the car CRM complex system. You can also develop your fintech app on a smartphone here are the solution that can help you create an app for this insurance sector BIMA and TROV.

BIMA:- It is an app that gives mobile-delivered insurance. They tie up with mobile network operators and financial businesses to provide low-income individuals with insurance. BIMA policy covers health insurance, accident insurance, come life and personal insurance.

TROV:- TROV provides a single property item from their mobile phone, so this TROV demands an insurance app. It also gives facilities to store the essential details about their property in this TROV app and back up their TROV cloud account data.

Regtech

Regtech helps to solve issues and challenges by employing innovative technology. Regtech solution company gives solutions by observing their company closely with ongoing processes and carrying out the details to solve the complaint with requirement guidelines. There are two different ways to reduce the risk of human error provided by the Regtech app.

6 clicks:- 6 clicks mainly stand for the compliance platform and global assessment phase. It also helps manage risk identification and gives reviews and assessments for stakeholders for the risk management lifestyle cycle.

Password:- Password is a platform that allows doing automatic KYB, KYC, AML, and other compliance cheques. It also provides to translate your compliance policies into a digital automated task that is based on onboarding.

Consumer Finance

Consumer finance enables a financial branch that more easily provides a user with the help of managing their expenses. With this type of fintech app, clients can use their spending in advance by making some plan; by this, their account balance can be forecasted in the future from spending more on making a plan. For consumer finance management, the fintech app has also developed an application mentioned in the following steps.

Mint:- Mint is a free budgeting app that keeps its eyes on the client to maintain their outgoing money and incoming money. This app can also be synchronized with a different bank account such as PayPal and a credit card.

Money patrol:- Money patrol is a tool that securely observes client financial accounts, so it is called personal finance. From this app, you can see the whole transaction overview of your spending in all categories.

Top 7 Things to Understand Before Starting a Fintech App

To create a successful Fintech app, you need to solve specific problems of the user. Solving the problem and building a Fintech app is like applying butter to bread for a financial software development company. However, fintech has many drawbacks, so to overcome the drawbacks and make your Fintech app successful, here are the 7 things to know about.

- Get to know the regulations

- Identify your niche

- Find your competitive advantage

- Hire the team

- Choose the tech stack

- Get funded

- Built and improve

Get to know the regulations

Banking and fintech are highly demanding industries, so you need to know about the ups and downs of this whole industry, including loss, regulatory authorities, limitations, and requirements. General data protect all business regulations that had been interacted with user data. This policy is the tip for all companies who are supposed to be in the finance industry. Moreover, Fintech rules include anti-money laundering known as AML, and know your customer known as KYC you should also need to operate other standardized mechanisms and digital certificates.

Identify your Niche

Here is some Fintech domain to be aware of lending, mobile banking, personal finance management, payments, international money transfer, Insuretech, trading an investment, crowdfunding, data analysis, financial decision making, financial product for small business, blockchain-based solution and cryptocurrency instead if you want to select some additional domain out of this that your product has to target some particular audience, for example, demographic group or country but if you launch your startup first and then expand to the market globally then it should be better for you o firstly focus on this domain time rather than selecting some others.

How To Create A Cryptocurrency Exchange App Like Binance

Find your competitive advantage

As your niche has been selected, you should get to know about your competition. While doing this will help you find what will differentiate our product from the existing solution, so you have to be aware and get a competitive advantage or unique value. This can ultimately reveal a new product and target a particular Niche mark, although it can improve the quality of offers existing in the market.

Now have a look at how fintech is increasing dramatically and know more business opportunities. However, this Fintech industry is getting more dominated by well-known significant software such as Microsoft and Ventures that are extremely successful. To stop this and control this Fintech market app, you should start betting on stellar execution on which you have an idea in most cases.

Best Innovative Web App Ideas for Startups to Make Money

Hire the team

First, you have to choose the right person to be on your side because it indirectly seems the key to success if you take the right person. To start up your financial app, you should attract finance app development and grow your team to face all the challenges to make it easy. If you hire some experienced developers, your app will not find significant obstacles, but experienced developers will not accept your deal at a cheaper value.

For a better startup, you should hire a financial software development company and choose the perfect location. By doing all these things together, you will create a powerful team with the specific domain and specialist and have the knowledge and legit experience for your app within a medium cost.

Choose the tech stack

For superior Fintech products, heavyweight customized software is mandatory. The tech stack that most of the software is provided in the market for Fintech apps is mentioned for you:

- Python

- Java and Ruby

- JavaScript

- C/C++

These are mainly used programming languages for Fintech app development moreover framework is also used such as:

- React

- Spring

- Django

- Node.js

Some of the databases are included to develop are:

- MongoDB

- PostgreSQL

- Redis

- MySQL

These are the main things you should know to develop a Fintech app, but the second thing you should have to give equal attention to is how you will create your Infrastructure and a cloud platform because it gives better and more robust offers towards DPOS. It also helps to recover the data online if any network issue has occurred.

Get funded

There are many different ways to get money for startups, such as capital to crowdfunding, bank loans to make power, and many other things. Moreover, you can also take money from your relatives and close friends. Still, if you choose the right way, then you can show your skills more powerfully and get efficient investors; by doing all these things together, you will get more funds and also, you can create an attractive visual prototype. Nowadays, a visual prototype is the best way to prepare a powerful pitch that can help you collect more funds faster.

Build and improve

I hope you got knowledge and guidelines about creating a fintech startup from all the points mentioned above. Still, if you create your fintech startup with a minimal viable product(MVP), it should be good and more efficient for you to develop. Secondly, create the features as per the need and try to improve the user’s complaint by daily checking the feedbacks then slowly and steadily increase the growth of your product. Using your brain smartly, launch your fintech app in the market where you can not find any risk factor.

What makes the Fintech app a Future of the Business

As fintech is growing fast daily, this fintech is proving aggressive for other business fields and financial fields. Indirectly, it is also helping other fields get more improvements in their particular field and reduce the risk factors such as lending process, online payment, management regarding wealth, and much more other finance that are internally connected.

On the other side, fintech is adding one unique technology for customer experience by adding the value of higher side and also adding some strategies towards the market to reduce the time of risk in the future if the business world by using some techniques and tactics here are some factors of fintech that gives surety to be taken care.

Rise of millennials

The first and foremost reason that made fintech more dangerous and in the limelight is the world of business taking interest and adding millions of new generation people; this all-new generation of people depends mainly on a platform like social media to gain financial advice or getting more information to become more involved in financial institution moreover, they are pretty demanding and less loyal for some personalized services at the ray of light.

As per the survey, 5 out of 2 million individuals change their bank account every 3 to 4 months to get more information and experience that drastic increment is needed to advance their technologies in the financial sector.

Fintech is following some rules before starting and developing the companies as compared to other financial institutions because fintech provides customized the option as the client is giving services for data utilization using technologies such as AIF Artificial Intelligence Finance which can make more satisfy and gain more revenue by helping in millions of business.

Payments app and digital wallets

This payment app digital wallets, P2P payment app, and digital wallets have not brought any success because the Fintech app has proved itself more aggressive in the market. These all digital wallets and payment app gives secure and quick access to the client to send their money and receive their money at any time and not facing any problem regarding the amount that individual can pay for their electricity bill, phone bills, travel bookings, and any payment and transactions can be done without carrying wallets in their pocket by doing this all thing they are gaining more trust and encouraging other business to create their finance app.

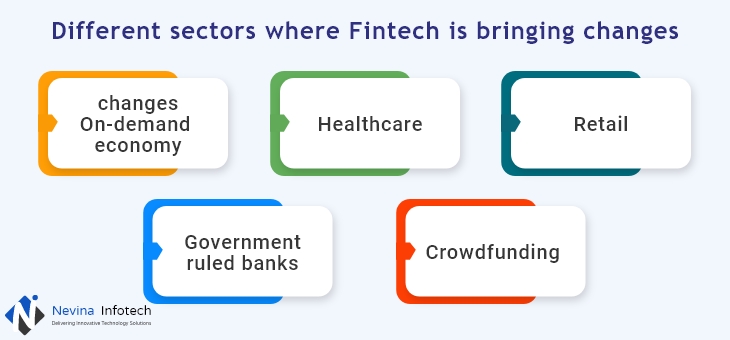

Different sectors where Fintech is bringing changes

After evaluating and knowing the various process of the banking sector in detail, fintech technology has decided to create a significant impact on other platforms and businesses. Still, before going into detail, we should explore and get details about each business. Here are 5 various things that we should know and get about it.

- On-demand economy

- Healthcare

- Retail

- Government ruled banks

- Crowdfunding

On-demand economy

Fintech is trying to provide an on-demand economy in many multiple ways for drivers and customers; both try to make one payment process. Users can connect their bank account with sharing app without suffering any difficulty while doing this process. They are also giving drivers more small business tools like automatic invoices and expense management, which will make the more easy financial process and upgrade productivity by doing these things together with different insurance companies and fintech startups.

They can also invest in the taxi sector and can offer all services together such as they can give some platform to that user moreover fintech apps such as coin based will increase their interest in promoting and making transactions to e-gift cards in the on-demand application.

Healthcare

This fintech company is also trying to provide new opportunities in the healthcare industry by helping the patients and healthcare sector with facing current challenges and proving experiences to them. Financial technology gives seamless payment solutions; moreover, there are new ways for several lending and insurance purposes.

Many medical technology startups have added fintech in their services to give all the medical services come under one wall. However, one significant rise has been observed in the adoption of blockchain technology in the healthcare industry. Payment can be done and possible via virtual by taking care of data security with smart contracts.

Blockchain in Finance: Blockchain Use Cases and Benefits

Retail

Here retail structures are enjoying the new transformation with finance app development unique customers with payment experience providing more experience to the user trying to make more possible interactions with a customer via retail stores and different platforms. Trying to make simple payments and checkout processes to help retailers get satisfied. Also trying to boost their strategy in the market by empowering retailers to know what things should be done to know their customers.

However, Retail is also giving knowledge about the loyalty program, paid and written program policy. Besides this, there are social messaging apps and digital payment apps to make it possible for the retail payment process via all payment apps and social media apps.

Government ruled banks

Fintech is trying to merge the government banks by offering multiple digital services and platforms to connect with delivered transport users and give impact-full solutions. They have got one way to do and achieve this. It has also started to introduce open banking. Open banking is a thing from which banking data can be shared among two or more independent users with APIs’ help.

These APIs permit enhancing customers’ experience, creating a sustainable service for the market, and generating revenue via approaching data sharing and lending. These all things are empowering fintech in multi-innovators as various one-off bank agreements cannot be possible with the financial industry, especially with the traditional model.

Crowdfunding

Compared with before time, it was complicated to gain trust in the market and raise funds potentially because due to lack of platforms, historical data, and resources are establishing brands and startups from getting out of the frauds. Still, with the help of the fintech app, the crowdfunding process has become more accessible.

Moreover, technologies are trying to bring more effective approaches to P2P payment and ease the process of investors with the fundraising process. It is also establishing financial institutions like NBFC and banks by encouraging fundraising platforms to make better services and offers in the market by following all this fintech technology to build a bridge with private investors and the public from which is get more funds and new avenues.

How much does it Cost to Build a Fintech App?

Before developing any website, one must fix their budget before developing it; this will help you decide which type of app to create and add to it.

The cost of developing a fintech app can vary depending upon the platform, features tech stack, and the number of members included in the team. Before selecting any financial software development company, one must fix the budget and price for developing the app, so this won’t create a problem in a long time.

The future will be depended upon the Fintech app as people are moving towards online transactions, so the demand for it will also increase. The cost of developing a fintech app can be $50,000 to $140,000 approx.

Conclusion

As mentioned above in this blog, you will get to know the information and knowledge about the need for businesses to invest in fintech apps. In this blog, you will get to know about the advantages and ideas about what to know about fintech apps and the future of fintech apps, and if you want to develop an app, you can also get an idea about fintech app design.

Nevina Infotech is one of the leading mobile app development companies that will guide you to develop your fintech app with the help of its fintech app developers as per your requirements.

FAQs

How to create a Finance App?

The answer to your question about creating a fintech app is mentioned in this blog; not only you will get the knowledge on app development, but you will also get an idea about the steps one should keep in mind while developing the app and also about the finance app development cost.

What Does a Fintech App Development Cost?

The fintech app development cost depends on many factors like the platform you choose to develop the app, the tech stack of the app, the team to develop the app, the features you want to add to the app, and much more. If you want to develop an MVP app, then the cost will not be much, but if you want to develop an app with more features and advanced functionalities, then the cost will be more.

What is a finance application?

A finance application is a digital tool designed to manage and track financial activities. It enables individuals and businesses to handle budgeting, expense tracking, investment monitoring, and more. These applications often offer features like expense categorization, bill payment reminders, and generating financial reports. Users can gain insights into their financial health, make informed decisions, and plan for future financial goals. Popular examples include Mint, Quicken, and Personal Capital, offering a convenient way to stay on top of one’s financial matters.