Blockchain is currently perceived to be on a high spectrum of expansion that has no limits to growth. As the progressive versions of Blockchain are unraveling with time, it has revolutionized the finance industry by moderating its work with concurrent multitasking.

Blockchain technology enables transactional procedures and distributed ledger records by performing as a decentralized platform to allow data exchange between multiple parties simultaneously. It provides a medium for limitless data storage of blocks (units of transactional data), reducing the costs for finance institutes.

Due to the autonomous and secured data recordings of blockchain, even masses are signing in their accounts for its given benefits.

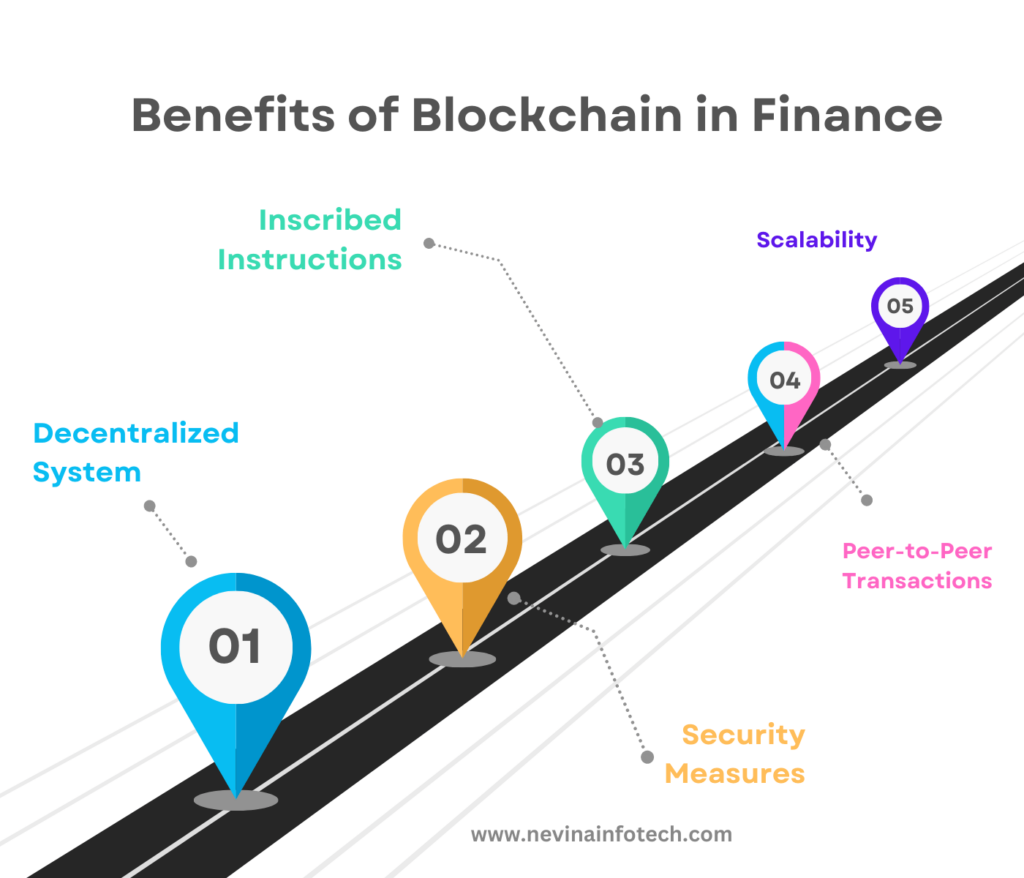

There are certain advantages provided by Blockchain in Finance industry that enables seamless data exchange between accounts.

What Are The Benefits of Blockchain in Finance

Decentralized System

In general, central authorities such as financial institutes, agents, or brokers have certain costs to invest for completing the transaction and withdrawal procedures. This lowers the account users’ certainty in these intermediaries’ proficiency to handle their accounts.

Blockchain eradicates such intermediaries by facilitating safe data exchange functions and transparency in ledger sharing. It has integrated standardized protocols that protect the multiple blocks of data while restricting external accounts.

Security Measures

Since the blocks of data stream synchronously altogether, they are recorded in data ledgers. However, access to this database is a matter of vulnerabilities that can be identified and invaded by any external threat, leading to data piracy.

Consequently, to avoid this, blockchain has cryptographically prescribed regulations for preventing illegal activities such as malware, external intruders, data tampering, and other threats that can cause unfortunate consequences.

In case any error persists in the blockchain operations, consulting the company that provides blockchain development services can analyze the issues accurately.

Inscribed Instructions

The blockchain contains a cryptographic code and standardization called smart contracts, that have inscribed terms and conditions to allow performing further transactions upon the agreement of both accounts.

After deploying these smart contracts programs, they facilitate smooth, safeguarded transactions between both parties as it autonomously detects whether each condition is met enabling the security of the data.

Why do You Choose Blockchain Development for Ethereum

Peer-to-Peer Transactions

Blockchain in finance has a certain mechanism to complete the transaction, where only the agreeable and affiliated participants over the transactional conditions can exchange their digital assets. This ascertains the security of the transaction data exchange as there is no intermediary involved in this process.

When the process seems to get hindered, hiring a blockchain developer in India with blockchain expertise can enhance the transactional process.

Scalability

Transactions vary with each participant according to their regionality and networking distance. Hence, blockchain allows the transaction to ensue from anywhere with various available preferences.

Blockchain has layered protocols, cryptographically encoded structure, and blocks unit distribution process for regulating the transactional flow simultaneously. To this extent, numerous transactions get managed and stored in the data ledger single-handedly.

Blockchain portrays a dominant role in the Finance sector by carrying out numerous transactions globally. Since it converts realistic assets into tokens and cryptocurrencies, it minimizes the transaction costs and documentation time for the users compared to the usual procedural duration.

With its advantageous functions, it has effectively changed the industry’s workflow in various distributed sectors. Blockchain in finance key uses enhances every minute task autonomously along with data warehousing.

It has some specific key uses in Finance sectors according to the categorized assets, and we explain them here for you.

Top Blockchain in Finance Key Uses

Assets Management

Each firm has several assets under its name that requires precise reporting of the investments made and how they compile with the laws and regulations. Moreover, these assets need to be classified according to their risk management, expected returns, and value in the current or lateral market scenario.

All these factors have to be managed and streamlined effectively by the firms to avoid any repercussions as the regulations keep changing. Hence, blockchain helps in managing them by:

- Autonomously administering and managing the funds and assets

- Enabling transparency and monitoring of assets allocation and stakeholders’ interests

- Engaging stakeholders by providing digitalized assets and portfolio

- Digitalizing, building, and the portfolio distribution for a wider reach to the market and liquidity management

- Fractionalized ownership and secured transaction flow within peers

- Tasks automation such as trade settlements, regulatory compliance, and fund launch for streamlining the workload

- Scalability via distribution of assets into units and allowing border investment opportunities

- Provides instilled incentives offers to engross the participants

Cross-Border Payments

On average, cross-border payments take days or even a week to complete the transaction from one country to another, especially considering the procedure starting from documentation to conversion of the assets or monetary value.

However, Blockchain in finance aids here by allowing cross-border payment systems through cryptocurrencies and integrating verification processing mechanisms such as KYC data. This discards elongated procedures of transferring capital or assets in the form of digital tokenization.

To this degree, it streamlines all the transactions conveniently and simplifies the procedural steps without incurring any extra costs and paperwork.

Capital Markets

The capital market means bridging communication between borrowers and lenders using currencies, bonds, shares, debt instruments, debentures, and other financial instruments. In the need of raising funds, any kind of firm, whether it is a startup or a well-established firm, requires enough investment for executing specific plans.

Raising capital is a challenging task where it is complex to convince the lenders, especially to promise in generating equal investment returns, pay timely interest, and manage liquidity risks from the capital amount they borrow.

To manage this all, the entrepreneurs or business owners require regulatory compliance, monitoring of overall capital, reporting, settling, and trading. Hence, Future Blockchain in finance aids in capital market assessment and management by:

- Eliminating intermediaries for the additional transaction procedures to minimize cost and time consumption

- Streamlining the process and monitoring capital market activities

- Tokenization of assets, capital, or instruments for convenient trading, settlement, and investment for gaining extensive market access to increase liquidity and decrease capital cost

Trade Finance

A systematic process of trading a financial instrument occurs through the intermediaries like banks and financial institutions and requires meticulous paperwork documentation for securing the authenticity and data of the account users. These instruments can be Purchase orders, bonds, letters of credit, and several finance elements traded on mutual conditions by both buyer and seller.

But, while carrying out a transaction, it can have errors and disparities in instances of disagreement or any paperwork issues. This can also increase the expenditure on the intermediary’s trade services.

Corporations having imperativeness of capital raise need it to be achieved instantaneously. In such cases, blockchain assists in rapid finance trading to minimize the security risks and documentation span within a few days or hours. A finance app development company upgrades the methodology of finance trading by integrating blockchain technology in the application to help the accounts in tracking, managing, collecting, and financing along with securing both parties’ integral data.

Blockchain in finance trading in various ways:

- Monitoring streamline of finance exchange with various instruments and alternatives to the letter of credits

- Global visibility and access for agile trade finance

- Minimizing the sources and time consumption in documentation review

- Regulatory and laws supervision control in cross-trade transactions

- Reducing intermediary costs in trading finance instruments

- Control on double-spending

- Inscribed cryptographic instructions of regulations and conditions

- Translucent data exchange and financing

- Provides greater advantage to SMEs or startups in apt finance trading

Lending

There has been a significant increase in loan purchasing by numerous participants over the years, which has enabled a new pathway to approach loans. Approval on loan requests is accepted after the completion of necessary documentation and signatures. And this process requires a long time of patience and multiple document factors on a timely basis.

Comprehending this, the majority of financial institutes are now adapting to blockchain technology as the masses have also moved on this platform for their convenience due to its following benefits provided:

- Autonomous, protected, and verified documentation using smart contracts

- Integration of KYC data with security measures to reduce fraud and scams

- Data exchange for verification directly to the stakeholders for their approval

- Payments and dues are automated through smart contracts cryptography

Stock Exchange

Usually, the investors, buyers, or sellers have to either directly communicate or make it official on an application based on its value in the market. The stock exchange involves trading securities from a particular stock exchange department, which is sold or bought at a fixed rate. This also is handled by a particular broker, agent, or institute that represents the instrument.

Blockchain technology has been simplified by constant monitoring, updates, and networking with traders. It avails the following functions for easy trading of the securities:

- Reducing additional costs of brokers or other intermediaries

- Visibility and tracking of the securities and their pricing

- Peer-to-peer transaction and communication with the trader for secured data exchange

- Eliminating paperwork and other processes of securities exchange while complying with regulations

- Cross-border securities exchange with negotiated pricing

How To Create A Cryptocurrency Exchange App Like Binance

Conclusion

Compiling with the laws, policies, and regulations of the financial institutes is indeed important. However, following up its procedures is a lengthy task consuming more time and costs. But, by integrating Blockchain technologies with the system, it leverages workflow by diminishing redundant tasks and distributing data units for secured data warehousing.

Account owners on blockchain rely heavily on being assured of keeping their transactions immune from external threats. Since this technology associates accounts with financial institutes, it has changed the working of finance institutes by complying with their laws and regulations.

According to some reports, Blockchain in Finance is expected to grow to approximately an estimated billion dollars by 2027. Fintech is evolving with the passing years due to its advanced autonomous functions and adaptation of new blockchain versions from blockchain development services.

Likewise, if you are looking for finance app development solutions, our team has expert blockchain developers in India who offer suitable consultancy and structured Fintech apps for your company.

Read Also:-