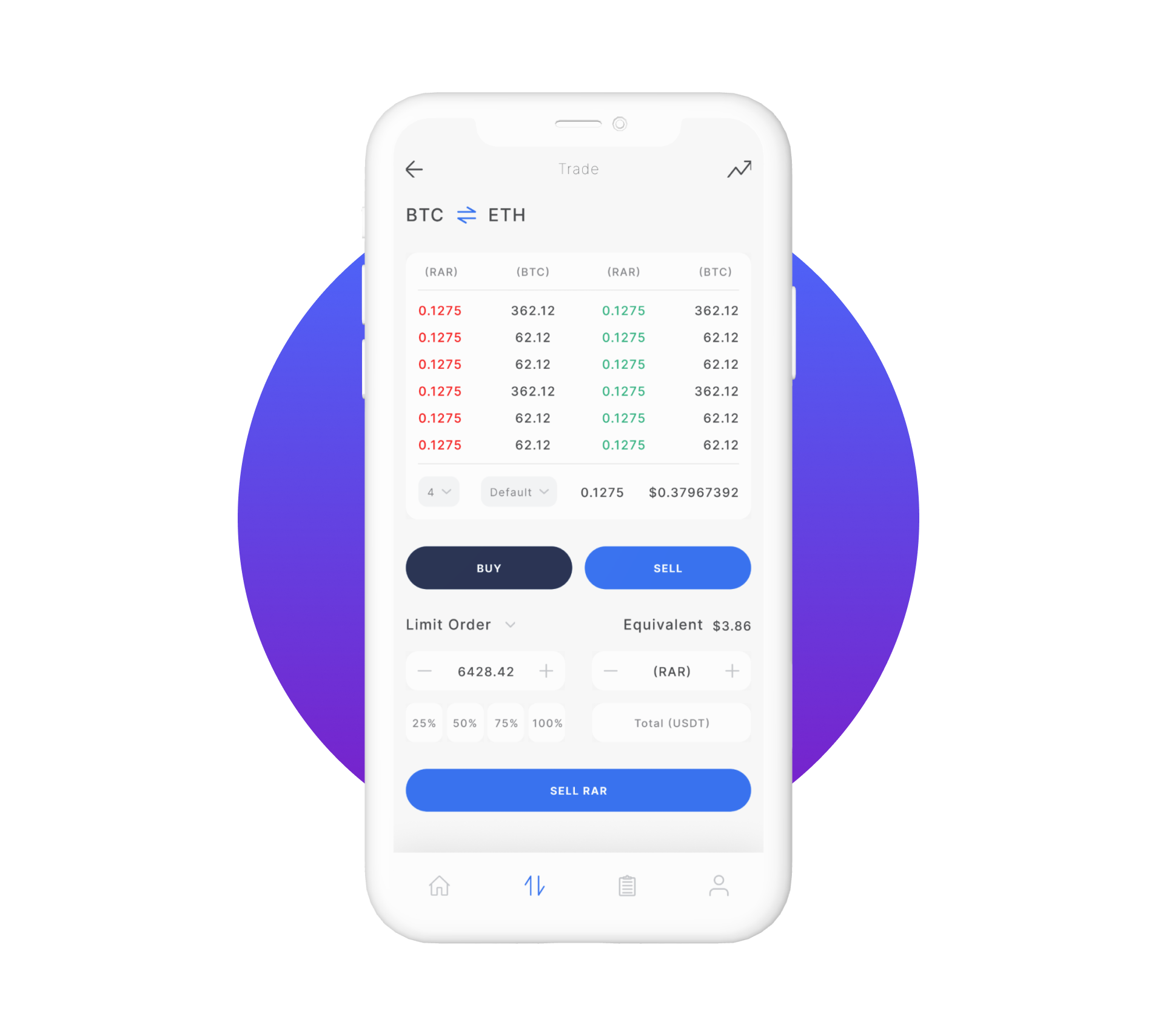

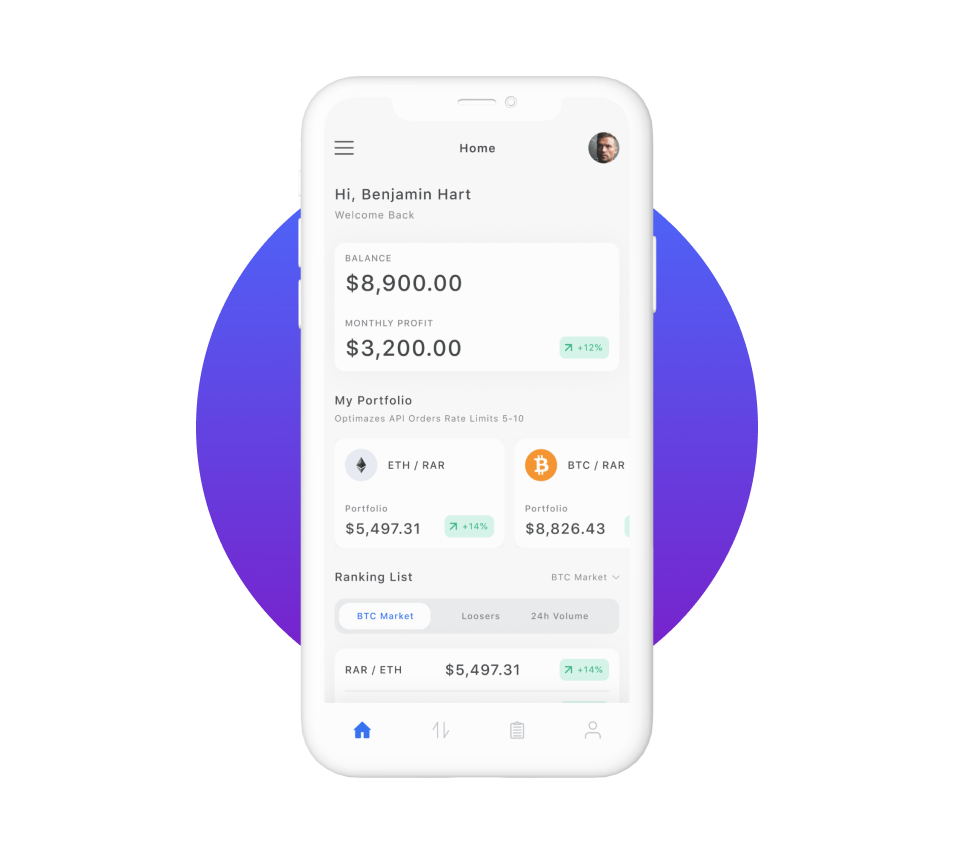

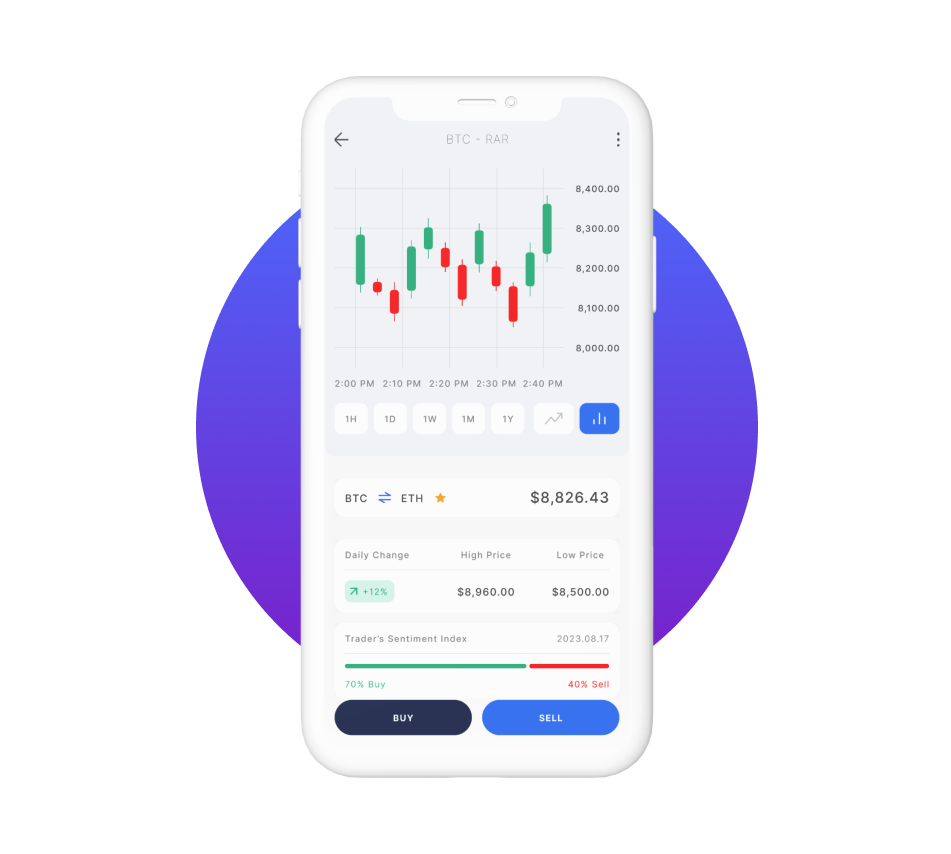

Leveraging our expertise in building user-friendly custom trading apps with clear interfaces and efficient communication modules, including proficiency in new and established development techniques. Choose our custom trading platform development services today!

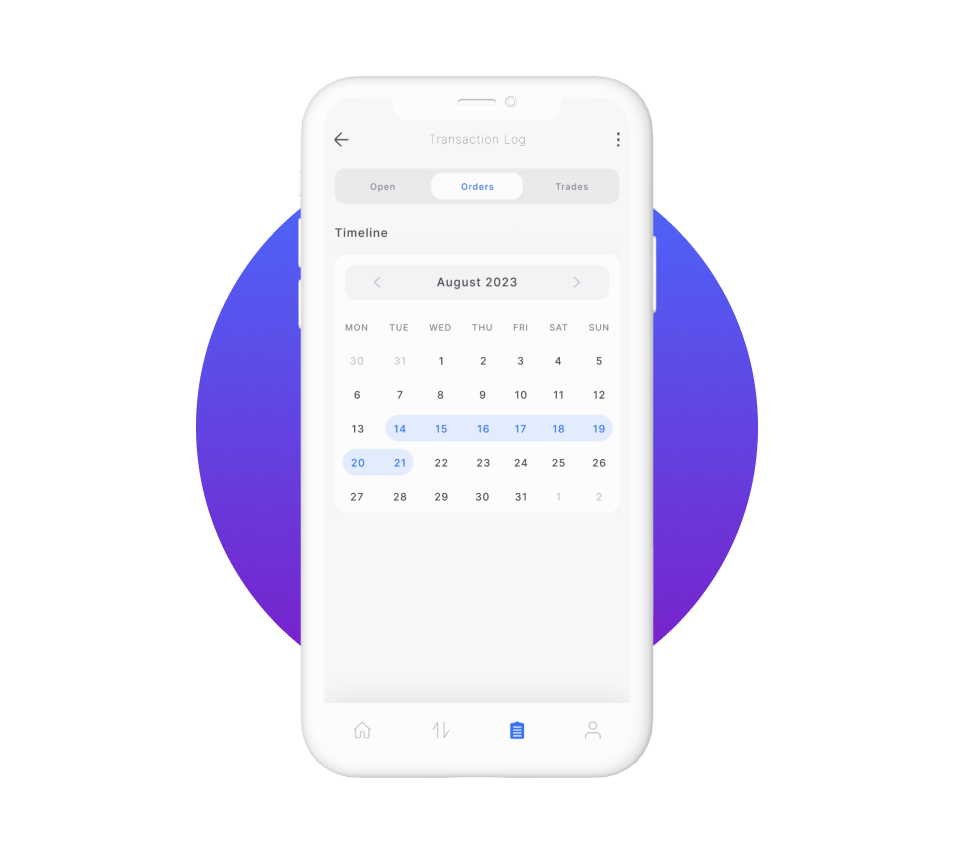

We produce competent transparency to the client-server to build long-term consistency within them. Our Custom Stock Trading Software has proficient software developers who can develop client-based mobile applications by keeping their requirements in mind.

Nevina Infotech is an Automated trading software development company that can leverage to provide you with trading software for expanding your businesses worldwide. With the help of our software development efficiency, you can enhance your trading knowledge online.