In today’s technologically driven era, moving towards digitalization is every business’s focus, including the insurance industry. The development of a mobile app for insurance agencies proves to be a significant advantage for customers. The escalating market demand has prompted insurance companies to focus on creating impactful applications.

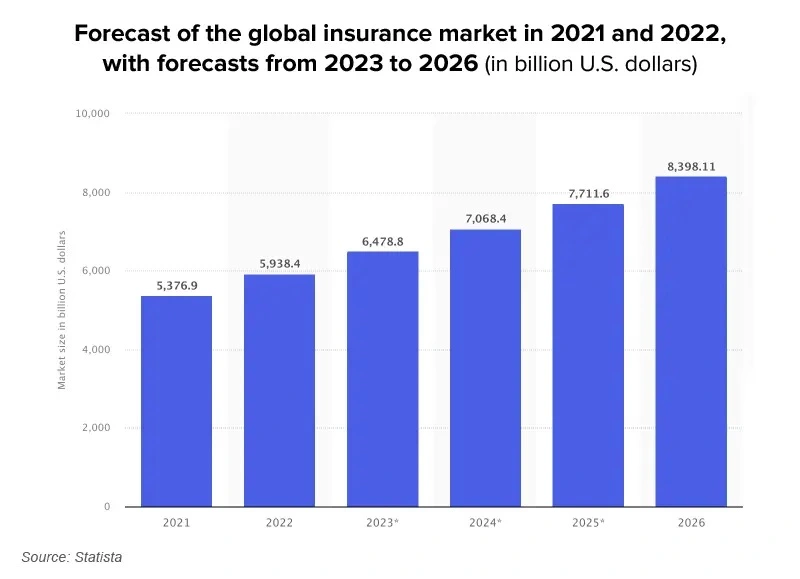

The insurance sector stands as a rapidly growing industry fueled by digitalization. Recent research indicates that the revenue of the Insurance Mobile apps market is projected to attain multi-million USD figures by 2026. This journey is characterized by a remarkable Compound Annual Growth Rate (CAGR) during the period from 2021 to 2026.

The convenience offered by a smart mobile application is unparalleled, irrespective of the type of insurance policies chosen by clients. Numerous fintech app developers are now offering top-notch insurance mobile app development services at affordable prices. The idea to develop an On-Demand Insurance App has not only drawn in users but has also spurred emerging insurance businesses to actively invest in app development solutions.

On-demand insurance apps consistently offer valuable services, guiding individuals to make sound investment decisions. For entrepreneurs seeking to integrate these services, it is essential to understand both the cost and features associated with insurance app development.

Overview of Insurance Mobile Apps

On-demand insurance apps offer technological solutions that simplify investment processes with convenience and ease. These apps often provide customers with special offers and deals to capture their attention. Individuals seeking investment plans for a secure future can easily purchase them through the app, eliminating the need to visit physical locations. Users can even submit all necessary documents directly to the agent through the app, streamlining the entire process.

Functionality of an Insurance App

A mobile app for insurance agencies serves as a user-friendly platform for managing policies and claims. The entire process is streamlined, offering convenient solutions to both policyholders and insurance providers.

Account Creation and Profile Setup

Users begin by creating an account on the insurance mobile app, providing essential details such as name, contact information, and address.

Policy Customization

Customers can explore the application to customize various aspects of their insurance coverage, including deductibles and coverage limits, aligning them with their budgets and specific needs.

Policy Management

The app allows users to directly manage their policies. They can pay premiums, update personal information, and monitor submitted claims, providing a comprehensive platform for policyholders to stay in control.

Claim Tracking and Communication

Users can track the progress of their claims within the application and communicate directly with insurance providers. This feature proves invaluable in situations requiring urgent attention, such as medical emergencies.

Types of Insurance Apps

Below are some of the types of insurance apps available in the market:

Insurance App for Customers

These apps are designed for policyholders to update policies, file claims, and facilitate communication between insurers and the insured.

Insurance App for Agents

This app aids insurance agents in closing sales more efficiently by providing access to customer policy history, filed claims, and other relevant information.

Insurance App for Vehicles

Emerging trends include apps that work in tandem with in-vehicle sensors. These IoT-based apps monitor driving habits and dynamically adjust premium costs based on behavior.

P2P Insurance App

Peer-to-peer insurance apps involve individuals pooling their insurance payments, and a single entity makes decisions about compensation in the event of an accident.

Industry Niche-Specific Apps

Insurance apps are even based on industries. For example, health insurance, car insurance, trade insurance, etc.

Benefits of Mobile Apps for Insurance Companies

The diverse range of insurance apps caters to the specific needs of different users and industry segments, enhancing the overall efficiency and accessibility of insurance services. Here are some of the benefits of these apps:

Process Automation

The incorporation of modern IT automation tools streamlines business processes, reducing paperwork and alleviating stress for insurance companies.

Information Dissemination

Progressive mobile apps allow insurance companies to convey comprehensive information about themselves, promoting their services and enhancing brand visibility.

Customer Base Expansion

The increasing number of mobile app users in the insurance sector necessitates staying updated to attract new clients and remain competitive in the market.

Regular Communication

Insurance apps facilitate continuous communication with clients, even in the absence of human operators, thanks to features like chatbots, ensuring timely responses to queries.

Simplification of Processes

Mobile apps simplify insurance processes, making registration and policy management more user-friendly for clients.

Personalized Offers

Mobile apps enable the collection of client information, allowing insurance companies to offer personalized recommendations and customized deals based on individual client data.

Client Feedback Management

Apps provide a platform for addressing client issues promptly, fostering client loyalty and satisfaction through efficient problem resolution.

Developing an Insurance Mobile App for Your Business

To develop a mobile app tailored to your business involves a four-stage development process. It’s advisable to begin with an MVP (Minimum Viable Product) to gather initial customer feedback and, upon achieving market traction, transition to a fully-fledged app for long-term success.

Discovery Phase

- Conduct in-depth analyses of the sector, encompassing market, competitor, and cost analyses.

- Create a blueprint of developmental activities, milestones, and major app features.

- Ensure clear understanding among team members to make informed choices and create a comprehensive project plan aligned with the brand voice for the mobile app development.

Design Phase

- Start with a design prototype to visualize the app’s look and functionality.

- Develop a product prototype to guide the development process and serve as an elevator pitch for investors.

- Utilize the blueprint generated in the discovery phase for technical requirements and business ideas.

- Deliverables: UX wireframe, UI design of app screens, clickable working app design, and a collaborative design file. You can also hire an app development company for better results.

Development and Testing Phase

- Transform the UI/UX design into a functional app with collaboration between backend and frontend programmers.

- Have a project manager oversee development, establishing milestones for adherence to guidelines.

- Quality assurance engineers conduct tests for security and stability after frontend and backend development completion.

- Ensure timely delivery and maintain project integrity with Nevina Infotech- One of the best Android app development services in India.

App Deployment and Maintenance

- Launch the app on the Apple App Store and Google Play.

- Prioritize user feedback for rapid improvements and updates post-launch.

- Increase user base to gather more feedback, enhancing the platform and insurance offerings.

All of us use feedback to address complaints and suggestions for ongoing product enhancement.

In all, these outlined stages of insurance app development emphasize the importance of customer feedback, efficient project management, and ongoing improvements to develop an On-Demand insurance app successfully for your business.

On-Demand Insurance App Development Costs: A Breakdown

Determining the precise cost of building an insurance app is challenging due to various factors influencing mobile app development expenses. Factors include app complexity, targeted platforms, device compatibility, geographical focus, the chosen development team, and design and development tools. You can vouch for iOS app development services to create an effective app without straining your budget.

Categories of On-Demand Insurance App Development

Simple On-Demand Insurance Applications

- Basic features make these apps ideal for developing Minimum Viable Products (MVP).

- Primitive user interface designed for a single platform.

- Estimated development cost: 30,000 to 120,000 USD (approximate range, actual cost depends on specifications).

Medium Complex On-Demand Applications

- More challenging development with advanced features like in-app chat support, payment gateway integration, and custom UI designs.

- Estimated development cost: 120,000 to 300,000 USD.

Complex On-Demand Applications

- Custom development with advanced features such as geolocation, BI tools, analytics, and predictive market forecasting.

- Built for streamlining business processes.

- Estimated development cost: 300,000 to 450,000 USD.

Important Considerations - The above cost estimates are approximate, and the actual cost depends on specific project requirements.

- For an accurate cost breakdown, consult with your chosen on-demand mobile app development India.

Understanding the on-demand insurance app development costs across these categories provides a framework for businesses to tailor their investment based on desired features and functionality. Consulting with an experienced mobile app developer India is recommended for precise cost estimations and to ensure successful project execution.

Essential Features for Mobile Insurance Applications

Many features are available in the mobile insurance application, which is a boon for the users as well as the business owner. Some of the benefits are:

Claims Management

The ability to submit insurance claims through the app is a crucial feature, providing customers with a quick and efficient way to report incidents. The app can enhance accuracy through the submission of videos and pictures, and it allows for location tracking for faster assistance, resulting in expedited claim processing.

Quick Access to Policies and ID Cards

The app should offer easy access to all policies, allowing users to review them on the go. It also eliminates the need to carry physical proof. If you hire iPhone app developers, you can understand the bliss of making an efficient mobile insurance app that is easy to use.

Payments

Simplifying the payment process is vital. The app development in India should include a payment section where users can add their cards and set up auto-payment options for convenience.

Virtual Agency

The app serves as a virtual representation of the entire agency, offering information on various insurance products and facilitating cross-referencing. It should include contact details and other crucial information for better communication and interaction.

Knowledgebase

The inclusion of educational materials related to insurance helps clients become more informed policyholders. The mobile application development India should offer interactive content instead of static PDF documents to enhance user engagement.

Insurance Agent App Development

For apps serving insurance agents, the focus is on enabling them to serve customers efficiently on the go. The mobile app design replicates a Customer Relationship Management (CRM) interface with all customer records. Here are the key features:

CRM Interface

The app should provide a mobile version of the CRM deployed at the agency, allowing agents to access customer records, manage interactions, and stay updated on client information.

Admin Panel

An admin panel on the web is essential for management purposes. This facilitates insurance enterprise app development and ensures effective control and oversight.

Quote Generation

If agents need to provide quotes, a separate functionality should be implemented in the app to streamline the process.

Claims Processing

The app should offer features for agents to process incoming claims efficiently, ensuring a seamless workflow.

Hence, both customer-centric and agent-focused features are essential for a comprehensive mobile insurance application. The goal is to enhance user experience, streamline processes, and provide valuable tools for both policyholders and insurance agents.

Advanced Features of an Insurance App

In addition to the three standard panels inherent in every insurance app, several advanced features enhance its functionality. These include:

- One-Tap Policy Selection with Filters and Controls

Simplifies policy selection for users by providing a streamlined process with numerous filters and controls for customization. - Robust CRM Solution

Assists marketers and the insurance company in driving sales through an effective Customer Relationship Management (CRM) solution. - Easy Payment Processing

Enables seamless payment transactions through various methods, including in-app wallets, NetBanking, Credit/Debit Cards, and more. - Policy Comparison Chart

Facilitates faster decision-making for customers by presenting a comprehensive chart for comparing different insurance policies. - GPS-Based Tracking

Allows real-time tracking of both agents and users based on GPS, facilitating efficient communication between the parties. - Cloud Support

Enables secure data management and access across all locations and devices, leveraging the benefits of cloud technology. - Heat Map View

Utilizes a heat map to visually locate insurance agents in specific geographical locations, optimizing service coverage. - On-Screen Signature

Enables customers to provide a digital signature of consent directly within the mobile app for authentication purposes. - Online Policy Selection and Preliminary Verification

Streamlines the insurance buying process by allowing users to select policies online and undergo preliminary verification for validation. - Notification and Alerts

Keeps both agents and users informed about the latest developments, ensuring timely communication and updates.

These advanced features contribute to the overall efficiency, user experience, and competitiveness of the insurance app, meeting the evolving needs of both customers and insurance providers.

Challenges in Insurance Mobile App Development

Although insurance mobile app development offers many advantages, several challenges must be addressed by insurance companies to ensure the success of their app. Key challenges include:

User Experience

- Challenge

Ensuring the app is user-friendly with an intuitive interface that enhances the overall user experience. - Solution

Prioritize user-centric design, conduct usability testing, and gather user feedback to continually improve the app’s usability or hire experts in app development India.

Integration

- Challenge

Seamless integration with existing systems and processes, such as policy management, billing, and claims processing. - Solution

Invest in robust API integrations and comprehensive testing to ensure smooth interoperability with internal systems.

Security

- Challenge

Protecting sensitive customer data, including personal and financial information, from potential cyber threats. - Solution

Implement robust security measures, such as encryption and secure authentication, and regularly conduct security audits to identify and address vulnerabilities.

Regulatory Compliance

- Challenge

Adhering to regulatory requirements concerning data privacy, security, and client protection throughout the app development and release process. - Solution

Stay informed about relevant regulations, involve legal experts in the development process, and conduct thorough compliance checks.

Maintenance

- Challenge

Ensuring the regular update and maintenance of the app to guarantee ongoing security and functionality. - Solution

Establish a consistent maintenance schedule, promptly address identified issues, and regularly release updates to improve features and security.

Successfully navigating these challenges involves a comprehensive approach that prioritizes user experience, security, compliance, and ongoing maintenance or taking help from mobile application development India. By addressing these challenges effectively, insurance companies can ensure the development and sustained success of a robust mobile app in the competitive insurance landscape.

Conclusion

In the evolving landscape of mobile technology, a clear trend emerges wherein an increasing number of individuals are inclined to prefer and manage their insurance policies through their smartphones. This shift towards mobile-centric interactions reflects a growing demand for convenient and accessible insurance solutions.

The rapid growth of the insurance mobile app market underscores the strategic focus of insurance companies in establishing their successful mobile applications. These apps serve as comprehensive platforms, consolidating a myriad of benefits for customers onto a single screen. The objective is not only to streamline the insurance processes but also to attract and engage a broader customer base.

As we navigate further into the mobile tech era, the significance of developing insurance mobile apps becomes more pronounced. These apps not only enhance user experience by offering seamless access but also contribute to the overall expansion and digitization of the insurance industry. Embracing this technological shift, insurance companies position themselves to meet the evolving preferences of their customers while staying competitive in the dynamic market landscape.

FAQs

How long does it take to build an insurance app?

The timeframe for building a dedicated insurance app varies based on its complexity. A highly complex app with extensive features may take approximately 9 to 10 months to complete. Conversely, a simpler insurance app with minimal features could be developed in around 3 to 4 months.

How can you reduce the insurance app development cost?

To optimize costs, consider developing a Minimum Viable Product (MVP) initially. This approach allows you to gather user feedback, test the market, and then transition to a fully-fledged mobile app once the MVP gains traction. Building a well-designed app with a focused feature list ensures success while managing costs.

How can you find the right insurance app development company?

When selecting an app development agency, prioritize teams with relevant experience in the insurance sector. Utilize platforms like Clutch and GoodFirms, which offer reviews and advanced filters. Explore client reviews, communicate with their previous clients for insights, and engage with potential candidates to make an informed decision. This thorough approach ensures a smooth and successful app development process.